It's still early in this MLB offseason, with plenty of big names still available via trade or free agency. So far, though, this sure seems to be a red-hot market: Both Kyle Schwarber and Pete Alonso cracked the $150 million mark at the Winter Meetings, while it seems like any reliever with a remotely viable track record has been able to snag a healthy multiyear deal.

Just going by the Hot Stove activity so far, you'd never know that baseball was barreling toward a potential work stoppage in just 12 months' time. It feels like just yesterday that all anyone could focus on was the looming expiration of the sport's collective bargaining agreement, and how inevitable it seemed that this cold war between Rob Manfred and the MLBPA would cost us games — and maybe even the entire 2027 season — as the league pushed for a radical reshaping of baseball's economic landscape.

And yet, that all feels like distant history now. If we really are at risk of losing baseball in a year's time, you'd never know it by looking at the actual teams and executives involved, and the owners whose money they're spending like drunken sailors.

MLB free agency so far suggests teams aren't sweating an eventual lockout

Below is a list of every multiyear deal handed out so far this offseason.

Player | Contract |

|---|---|

Dylan Cease | Seven years, $210 million |

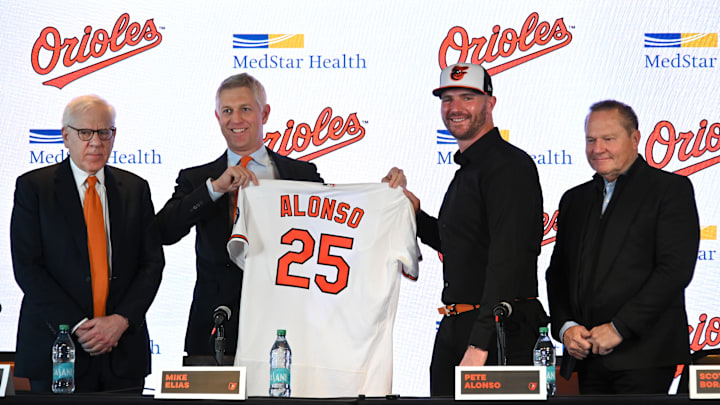

Pete Alonso | Five years, $155 million |

Kyle Schwarber | Five years, $150 million |

Josh Naylor | Five years, $92.5 million |

Edwin Diaz | Three years, $69 million |

Devin Williams | Three years, $51 million |

Robert Suarez | Three years, $45 million |

Jorge Polanco | Two years, $40 million |

Steven Matz | Three years, $37 million |

Cody Ponce | Three years, $30 million |

Ryan Helsley | Two years, $28 million |

Mike Yastrzemski | Two years, $23 million |

Emilio Pagan | Two years, $20 million |

Kyle Finnegan | Two years, $19 million |

Steven Matz | Two years, $15 million |

Danny Jansen | Two years, $14.5 million |

Phil Maton | Two years, $14.5 million |

It runs 16 players long in all, a very healthy number for this point in the winter. But just as notable as the overall number are the specifics: Pete Alonso, a player with serious questions about his aging curve, got a five-year deal that will take him through his age-35 season with an AAV of more than $30 million; Kyle Schwarber and Josh Naylor are one-dimensional players who got deals at or near the top of their projected markets; Edwin Diaz set a new record for AAV for a reliever; Dylan Cease is making $210 million, for goodness' sakes.

All of those deals can fairly be categorized as aggressive, the sorts of contracts that will likely become dead weight by the time the players involved reacher their decline years. Given that context, it's hard to believe that the market would've developed this way if teams were genuinely concerned about missing most or all of the 2026 campaign.

Alonso, for example, is the sort of slugging righty first baseman who will fall off a cliff as soon as the decline comes. Baltimore certainly knew that in advance, and yet they signed him anyway, wagering that the Polar Bear's near-term production (while guys like Adley Rutschman and Gunnar Henderson are still cost-controlled) would make it all worth it. The 2026 season getting wiped would be devastating for that plan, wiping out one more year of Alonso's dwindling prime and leaving the O's on the hook for years that likely won't be worth anything near $30 million per.

Even players like Suarez and Rogers, relievers entering their age-35 seasons, got three-year deals from teams that fully expect to contend for a postseason spot in 2026. The Jays figure to have been far less bullish on the notion of paying Rogers more than $12 million a year until he's 37 if they thought it were realistic that the first of those years would be axed due to labor strife.

Overall, just about every deal signed so far has come in at the top of, or even above, most analysts' projections. And why not? After all, while Manfred has talked a big game on his grand "please consider a salary cap" tour, he and the owners who employ him understand the score here — and they know that they can ill afford a work stoppage at the worst possible time.

Rob Manfred, MLB owners have every reason to back down

Manfred received plenty of praise when he managed to piece baseball's broadcast rights deal back together following ESPN's opt out earlier this year. MLB's national package was left twisting in the wind when the Worldwide Leader abruptly bailed, and the league's pivot managed to bring exciting new players into the fold at a healthy price.

But there was another reason for excitement: The new deals (one with NBC, one with Netflix, one with ESPN's new subscription services) are all set to expire at the end of the 2028 season, which just so happens to be when the rest of the league's rights agreements, most notably for the postseason and World Series, also run out. Which is great news for the sport, allowing MLB to renegotiate its entire broadcast suite from a position of strength ... you know, provided a lockout doesn't short-circuit every ounce of momentum.

We've seen this movie before: Both the NHL and the NBA suffered dips in enthusiasm and ratings in the immediate aftermath of lockouts that led to missed regular-season games. If baseball's labor cold war leads to an actual stoppage, it'll take years to undo the damage and replicate the heat the sport has right now. Rather than taking record ratings to the negotiating table, Manfred would be stuck with his tail between his legs, offering a subpar product and locking himself into below-market deals for his most valuable properties.

That is, to state the obvious, a scenario no one wants to see. It's in everyone's best interest to pull back from the brink, and the league and its owners can't be stubborn enough to push the salary cap issue so far that there's no coming back. Front offices seem to agree, at least if this offseason has been any indication so far.